Critical Minerals in the Deep Sea and Accompany Sustainability Concerns

- Akinola Afolarin

As the international community continues to seek alternatives to fossil fuels, the recent discovery of critical minerals in the deep sea could not have come at a better time. Over the years, the world has relied on the availability of cobalt, manganese, graphite, and nickel for battery production. The supply chain for these critical minerals has recently come under scrutiny, with concerns being raised about significant environmental risks, price fluctuations, human rights and labor abuses, geopolitical and other risks. As corporations continue to develop forward-thinking and sustainable solutions in the energy market, it is also important that they pay attention to the risks that may exist in the supply chain of these critical materials, and adopt a strategy that would effectively mitigate these risks.

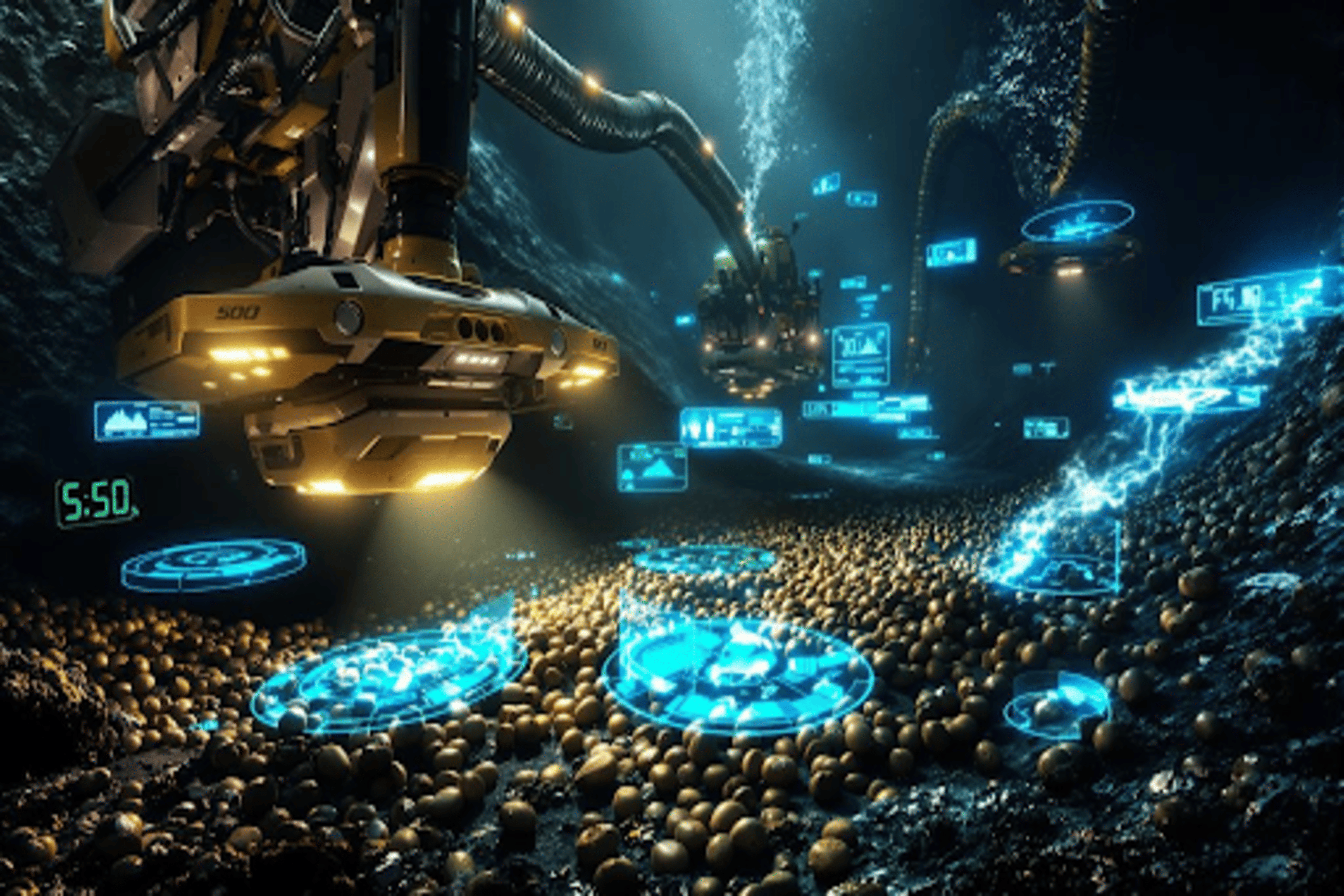

Critical Minerals in the Deep Sea

Before now, the mining of critical materials such as cobalt, manganese, lithium, graphite, and nickel was carried out onshore. The availability of these materials has been essential for the production of Electric Vehicle (EV) batteries,

wind turbines, solar panels, and other low-carbon technologies, thereby providing a viable alternative to fossil fuel. Although there was initially a concern over their long-term availability, the recent discovery of these minerals on

the seafloor seems to provide a potential solution to this.[1]

Found largely in the Clarion-Clipperton Zone, [2] about two million miles of the ocean between Hawaii and Mexico, the mineral deposit on the seafloor is estimated to be worth between 8-16 trillion US dollars. In February 2022, the White House [3] found that global demand for these minerals could rise by as much as 400%-600% as the world’s reliance on solar power, electric vehicles, batteries, and other zero-carbon technologies increases. If current projections are anything to go by, the energy industry might have found a sustainable alternative that will lead to a significant emissions reduction in the future. Notwithstanding, the supply chain of these critical minerals comes with some fundamental questions that could expose many energy companies to some Environmental, Social and Governance (ESG) risks if not carefully navigated.

What Risks Exist?

-

Beginning with Environmental risk. Although seabed mining takes place offshore, concerns have been raised about its potential environmental risk to the ocean ecosystem. According to the World Economic Resources,[4] this risk includes direct harm to marine life, long-term species and ecosystem disruption, possible impacts on fishing and food security, economic and social risks, and potential climate impacts. These environmental concerns can negatively impact a company’s sustainability goals and its perception by investors and customers.

-

Potential risk of Labor and Human Rights Abuse. Abuse of this nature has been reported in the past in distant-water fishing operations.[5] A company that seeks to source its production materials from the abundant materials on the seafloor must therefore put in place, a mechanism that will address these potential abuses, which could potentially ruin the reputation of the company if left unchecked.

-

Another source of potential risk is Price Fluctuation/Unpredictability. The “harvesting” of these critical minerals from the deep sea is a recent development. They will therefore expectedly be subject to some factors including market forces, regulations, and geopolitical considerations. Although the minerals are said to be in abundance, it is doubtful if anyone can guarantee long-term price and supply with a degree of certainty at this time, given the current state of things. These uncertainties can have long-term impacts on business, customers, and returns for investors. These therefore call for a cautious approach.

-

Regulation is also a potential risk. The extant rule on seabed mining is set by the United Nations agency called the International Seabed Authority (ISA) established by the United Nations Convention on the Law of the Sea (UNCLOS). Typically, the ISA regulates mining activities in the sea and protects the marine environment from harmful effects. With the latest development in deep-sea mining, the ISA is expected to formulate a more comprehensive regulation to meet current needs in deep-sea mining. This expectation comes with a degree of unpredictability which requires corporations to further study the market and accelerate due diligence in this area.

-

Of equal significance is Geopolitical concern around deed-sea mining and what impact this may have on American corporations. As mentioned above, deep-sea mining is regulated by the United Nations Convention on the Law of the Sea (UNCLOS), a treaty that the United States has not ratified. The United States therefore has limited influence in the conversation. On the other hand, some of the 168 member nations of the (ISA) are already taking steps to maximize the benefits of these mineral deposits. Given that the most valuable of these minerals are mined from international waters where the US has no access, this potentially leaves US corporations with weaker bargaining powers, as they will have to rely on foreign miners for their supply. While it is uncertain if this development will cause the United States Congress to ratify the UNCLOS in the future, relying solely on foreign supplies for these minerals will have significant impacts on the affected American company businesses in terms of cost, increase in prices, and ability to compete internationally. Although President Trump in April 2025 signed an Executive Order aimed at shifting the United States policy toward seabed mining, the US action has been opposed and described as illegal. The coming years will reveal whether there can be a successful diplomatic effort to reconcile the United States position in line with the international governance frameworks on seabed mining.

Managing Potential Risks.

In the meantime, it will be helpful for energy sourcing and production companies that rely on these critical

minerals for their operation to exercise caution. In order to address the highlighted risks, a firm-wide in-depth risk assessment,

engagement with stakeholders (investors and customers), and development of an effective risk mitigating strategy around its supply chain are essential steps toward proper management of future risks.

[1]60 Minutes;https://www.youtube.com/watch?v=vFaWgAXax1Q

[2] These minerals are also found in other parts of the high sea, including the Sweden, Finland, Norway, and Greenland Exclusive Economic Zones (EEZ).

[4] World Economic Resources; https://www.wri.org/insights/deep-sea-mining-explained .

[5] Human Rights Watch: Hidden Chains; Rights Abuses and Forced Labor in Thailand’s Fishing Industry; https://www.hrw.org/report/2018/01/23/hidden-chains/rights-abuses-and-forced-labor-thailands-fishing-industry?gad_source=1&gclid=CjwKCAjwyJqzBhBaEiwAWDRJVMnsvDsoKYV13ZTGyQQmDzy9313paGumMWoiFQ29d--F1oAfw3CVnBoCdmMQAvD_BwE.